More and more, companies are willing to drop large sums to grow their user base, and digital marketing spend is expected to grow to $645.8 billion by 2024. With this ballooning spend, businesses need to be more aware than ever of exactly what the results of that investment brings in.

At Insivia, we believe that budgeting marketing and advertising without knowing user acquisition cost is like sailing without a compass. The ugly truth is that in early stage SaaS businesses, far too many have no idea what their user acquisition cost (UAC) is, and are not actively seeking to determine this critical metric. Throughout this post, we’ll share what user acquisition cost is and why it matters for your business. We’ll also dig into how to get the return on investment from your marketing that’s right for your business to increase leads and improve your user base.

What is SaaS User Acquisition Cost?

CAC is calculated by taking the overall cost of acquiring customers including both sales expenses and marketing expenses and dividing that cost by the total number of customers that were acquired. The cost and total customers must both be from the same period of time.

CAC formula visualized by HubSpot

Example of CAC Calculation for SaaS

Let’s try out the CAC formula in a real world example. Let’s say you are on the growth team at a SaaS firm and you’re looking back on 2021. You get the data from your team to determine how many customers were acquired in 2021 and how much was spent on marketing and sales to acquire new customers.

If you spent $1 million on sales and marketing in 2021 and acquired 4,000 new customers, your CAC would be $250. Overall, your customer acquisition cost is $250 for 2021.

What Factors into CAC?

All sales and marketing costs factor into CAC. To make sure that this number is fully inclusive of all sales and marketing activity, here are a few factors to consider.

Advertising Costs:

Costs that go into SaaS product promotion to your target customers. These could be paid digital marketing ads, sponsorships, print advertising, whatever your company uses!

Labor:

Salaries factor into CAC. The salaries of people on the sales/marketing teams are included in CAC, along with sales commissions. Be sure to remember the costs of any freelancers or contractors too!

Overhead:

Any other expenses that keep the marketing/sales ship up and running. This could be tools your team uses, equipment they need to get their job done, travel expenses, trade show costs, rent, and so on.

What Can You Learn from Calculating CAC?

If you’re still in the process of fine-tuning your product and finding your ideal target customers, the cost of customer acquisition will see a lot of variation.

However, many SaaS companies grow faster than they realize they’re spending. The growth curse can be growing without an awareness of how much the company has spent to achieve this growth, and a rude awakening is realizing that you’re not actually profitable due to these costs.

As your product shifts and changes during the refinement process, the analysis of your CAC through these changes helps keep a pulse on how much money is going into customer acquisition. CAC will help your business be prepared for growth.

Going back to our concept of payback period, the time your business needs to get back the CAC through your revenue will vary heavily by business models. The ideal scenario is that it takes no longer than 12 months to regain the cost of acquiring new customers.

For a new SaaS business, this might not seem like a feasible timeline at this point. That’s okay – while you build up to that, use that time limit as a goal to aim for as your business grows in maturity. Cash flow is important to a healthy business, so recovering these costs at a steady pace helps keep business booming.

User acquisition cost (UAC) can also be known as customer acquisition cost (CAC). CAC is the average cost it took to close a new customer after you’ve calculated the expenses of marketing and sales tactics that it took to draw them in. These expenses should include the people, tools, property, anything at all that was used during the process of marketing and selling to the customer that helped convert them.

CAC can be calculated by dividing the money spent on attracting and converting the customer during a period of time with the total number of customers that were converted during that same time period. CAC shows us what financial effort went into enticing someone to actually make a purchase.

The lower your CAC is, the better your sales process is. On top of that, a lower CAC means a higher ROI.

Why is Customer Acquisition Cost (CAC) Important for SaaS companies?

The business model of SaaS companies make CAC inherently critical by nature. SaaS’s business model has a large dependency on the lifetime value of a customer, making the cost of finding new customers related to their value overall.

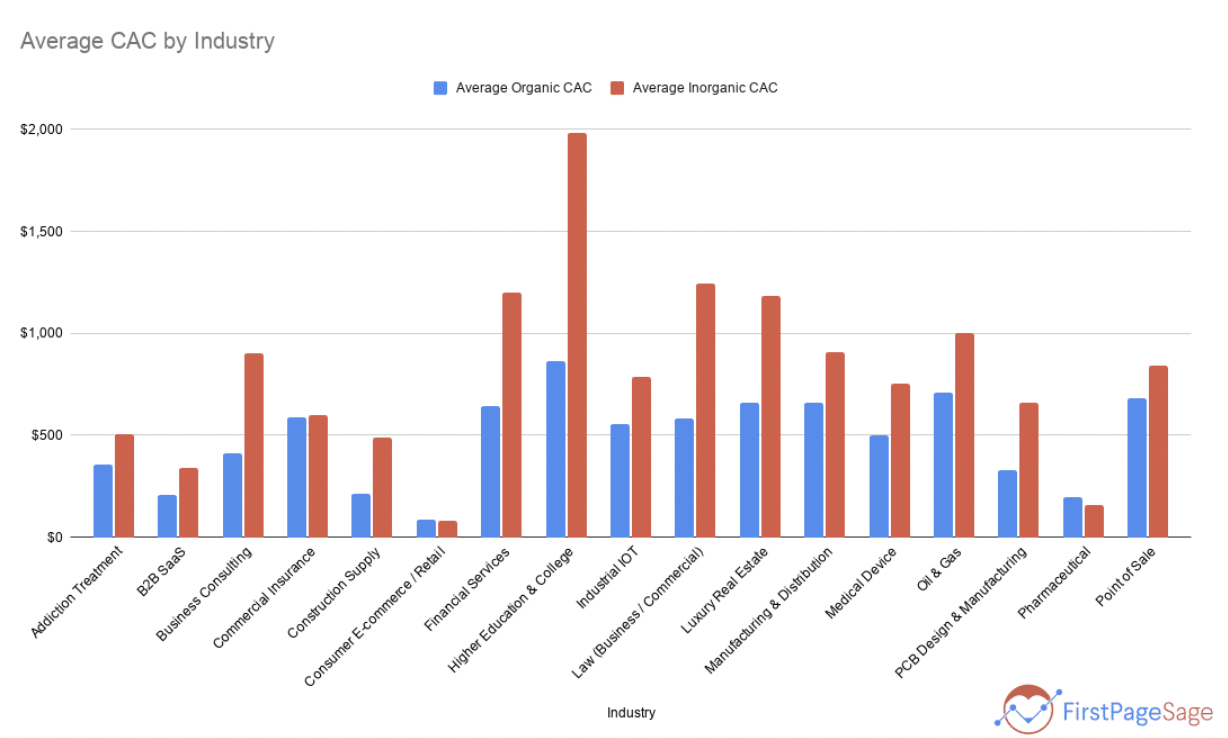

FirstPageSage calculated the average CAC by the industry of their clients. B2B SaaS comes in with an average CAC between about $100-400.

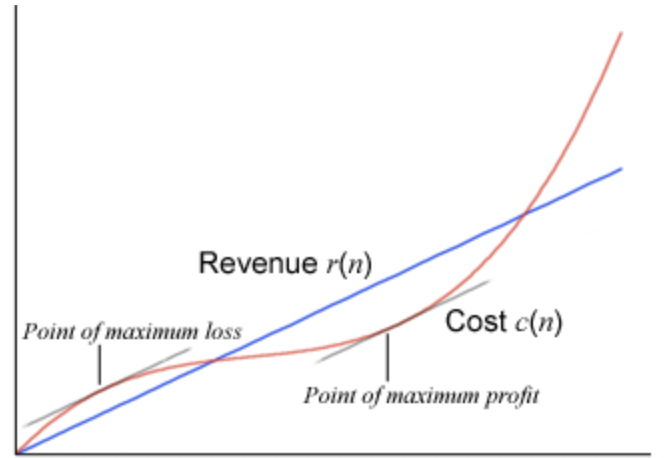

Determine Point of Profit

New SaaS companies often spend a significant amount of effort, money, resources, and time to attract new customers. This investment often occurs before seeing any type of profit from this investment. An overall analysis to determine where the inflection point is when the investment put into attracting the customer meets the profit made from the customer is key to understanding a SaaS company’s returns.Let’s use an everyday example.

Say you buy yourself a $1000 fancy coffee machine to kick your habit of buying $5 lattes every day. For this investment to be worthwhile, you need to be receiving value from the coffee machine. At the point that you’ve made yourself 200 coffees instead of buying them, you’ll have broken even.

This “200 coffee” number is the point where you’ve recovered your CAC and start to profit from your choice to buy the coffee machine.Your business needs to identify what this point will be for your customers – to recover the CAC and start to make a profit.

Visualization of CAC inflection point from priceintelligently.com

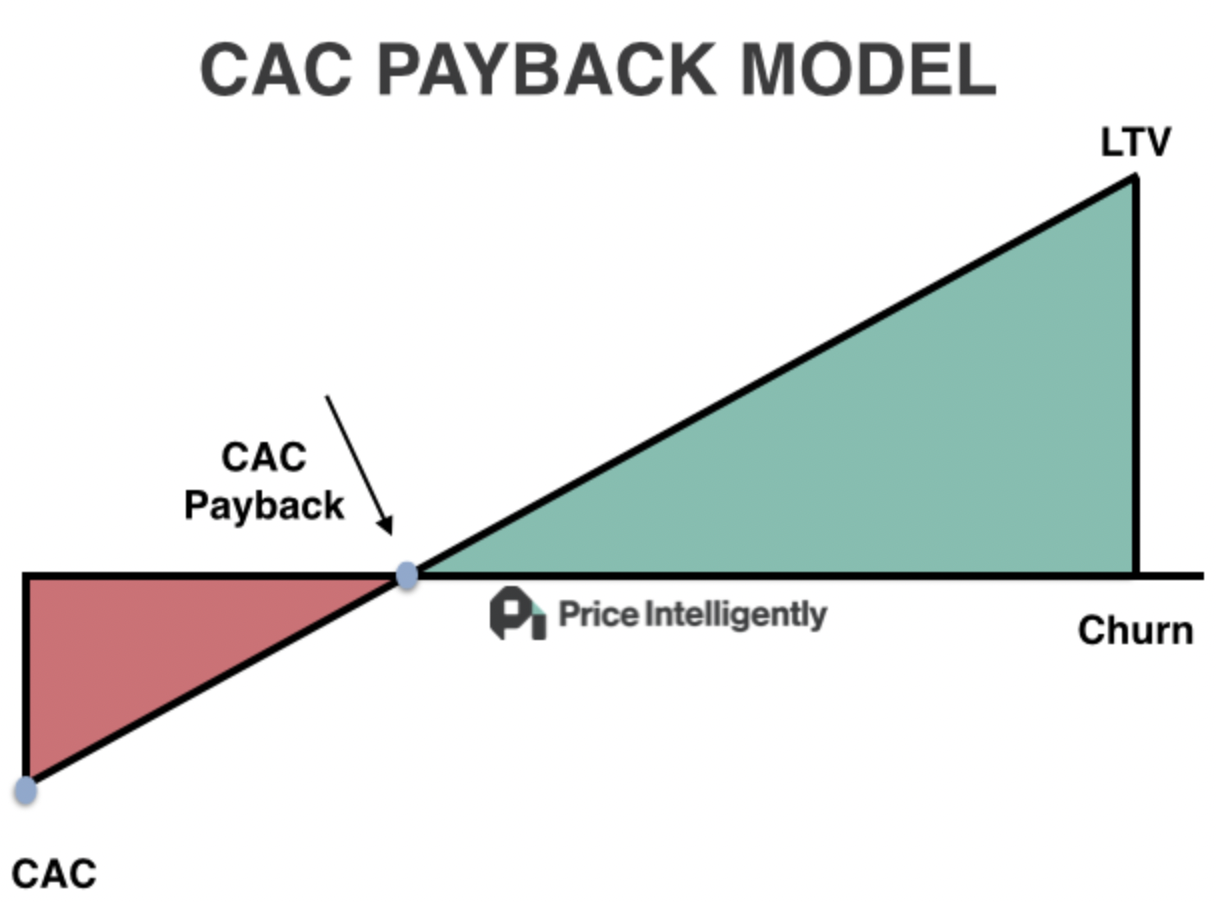

Understand Your Business’s Payback Period

The timeline at which you reach this point of profit can also be thought of as a “payback period”. The payback period is a key piece to calculating and understanding CAC.

Your payback period is how fast or slow you get profits from customers. This payback period determines the speed at which you can take the cash from paying customers and put it back into your business to help you grow.

For a business to be profitable and grow, there must be a solid and consistent cash flow. Money that comes in today can help you grow faster rather than money coming into the business at a later time.

Payback period as visualized by priceintelligently.com

Set Informed Pricing Models

CAC also helps set informed pricing models. CAC can vary across different customer types and personas. You can identify high value customers as well as customers who use your lower cost or “freemium” models. The CAC will vary by segment, and will be a key part of your pricing analysis.

Are the high value customers incredibly expensive to gain and keep? Are the cheaper customers hindering you from making better revenue? Determining your CAC can help identify the full picture of your business’s pricing model. You can identify your margins and your profits as you grow. Your business needs to know these numbers to not only stay in business, but to grow as well.

To get the most out of your customer acquisition cost calculation, combining it with lifetime value (LTV) gives you even deeper insight into your pricing and profitability.

Lifetime value, also referred to as customer lifetime value (CLV), is the average revenue that a customer is expected to generate during the span of their time doing business with you. It ultimately estimates the average gross revenue that an individual customer will bring to your business before the end of the business relationship.

One important distinction about LTV: LTV is about a customer’s worth to a company, not necessarily how much they pay.

Why is LTV helpful for SaaS?

LTV is useful to SaaS companies due to the nature of how they often aim to have long-term relationships with their customer base. LTV is super helpful when there is a multi-year relationship with a customer, such as with a collaboration service platform or a marketing automation platform.

Visualization of LTV by chartmogul.com

Visualization of LTV by chartmogul.com

The visualization above shows a customer’s lifetime. They sign up for a $50 service and renew that service twice at $50 per renewal. By their third renewal, the customer has decided to cancel. This adds up to a $150 LTV for this customer prior to churn.

How do CAC and LTV go together?

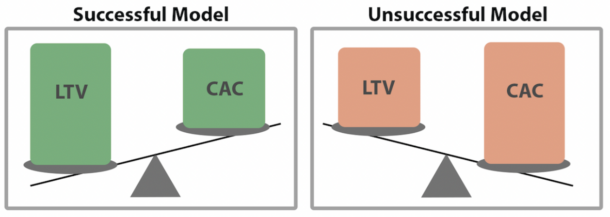

LTV helps create a “boundary” for your CAC. If you understand your average LTV, you understand how much revenue your business generates from the average customer. By calculating both CAC and LTV, you can determine if you’re spending more on acquisition than you expect to receive in revenue. If your CAC outweighs your LTV, it’s an indicator that things need to shift as soon as possible.

LTV and CAC for a successful business vs. unsuccessful via profitwell.com

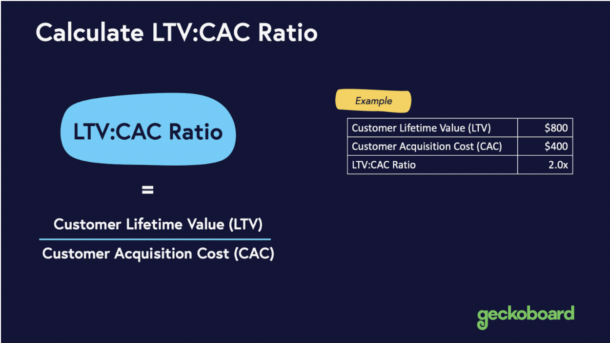

Calculating LTV:CAC Ratio

LTV to CAC ratio is an important calculation to help understand your spending on acquisition. The ratio will help point you in the direction of whether you’re spending too much on acquiring each customer or if you’re being too conservative and missing out on potential customers.

Once you’ve identified both your LTV and CAC, you can calculate your LTV:CAC ratio. Finding this ratio is simple: divide your LTV by your CAC.

For example, say your LTV is $4,000 and your CAC is $2,000. Your LTV:CAC ratio in this case would be 2:1.

Visualization of LTV:CAC ratio shown by geckoboard.com

Indicators of a Good LTV:CAC Ratio

The SaaS industry standard is a ratio of 3:1 or higher. The higher the LTV:CAC ratio, the better. When the ratio is higher, it means your sales and marketing strategy and tactics (e.g., Google Adwords, Facebook ads) have a higher ROI.

However, if your ratio is astronomically high, this doesn’t mean you’re absolutely making a killing. Rather, it means that you are probably holding yourself back from growth by spending too little.

Here are a few rules of thumb:

- A ratio of 1:1 or lower means that you’re losing more money than you’re making. This is not good!

- 3:1 or better is generally good.

- 4:1 indicates an impressive business model.

- 5:1 or higher means you’re likely not growing as fast as you coil and that you’re under-investing in your marketing tactics.

If throughout this process you’ve realized that your CAC is higher than you’d like, don’t worry. There are a few different methods to optimize your CAC and set yourself up for growth.

Understand, define, and quantify your customer personas

Make sure you have properly defined customer personas and quantify these customers. Dig into things like sales cycle length, willingness to pay, conversion rates, what each persona is motivated by, etc. This is a full qualitative and quantitative analysis exercise.

Analyze and revise your sales and marketing spend

Identify which channels have proven returns and take a hard look at your spending on acquisition tactics. Make sure you’re not throwing away cash where it’s not converting into revenue.

Optimize the sales and marketing funnel

What does each step of your sales and marketing process look like? How do people move through your funnel? What are your drop off rates? Determine the conversion rate of each stage of the funnel, and quantify each stage of your process.

Optimize your pricing

Pricing strategy goes hand in hand with what you’ve learned about your CAC and LTV. By optimizing your pricing strategy, you can determine methods to earn cash from target audience up front as a way to improve CAC through things like start-up costs; this will lead to profits coming in as soon as possible.

Through all the ratios, calculations, and acronyms of CAC and LTV, the goal remains the same: run a revenue-healthy, growing SaaS business.

Looking to improve your user base and help your company grow? Contact Insivia to increase your lead generation and grow your pool of active users.

Written by: Tony Zayas, Chief Revenue Officer

In my role as Chief Revenue Officer at Insivia, I am at the forefront of driving transformation and results for SaaS and technology companies. I lead strategic marketing and business development initiatives, helping businesses overcome plateaus and achieve significant growth. My journey has led me to collaborate with leading businesses and apply my knowledge to revolutionize industries.